- The Trading Initiative

- Posts

- Why Missing the News Cycle Was the Best Trade Last Weekend

Why Missing the News Cycle Was the Best Trade Last Weekend

Focusing on Price Action Instead of the News Cycle

Last weekend was great.

I took my 1-month son to the beach for the first time with our entire family and spent the weekend drinking caipirinhas and eating churrasco.

Southern Brazil is wonderful this time of year with temperatures sitting around 75 degrees, low humidity, and no rain.

So it was a blessing in disguise when our Airbnb host told us that the internet wasn’t working well.

At first I did what most people would do nowadays—walked around trying to find signal so that I could hop onto X and read what was going on.

After about 30 minutes I succumbed to my fate. I was going to be locked out from the world for a majority of the weekend.

What a blessing that turned out to be.

I missed the entire news cycle starting Friday morning through yesterday night.

The Chinese trade war escalated. The European Union wants to impose reciprocal tariffs on the US. Japan sent a delegation to talk to the White House and left more confused than when they arrived. Russia and Ukraine had an Easter treaty that was violated over 4,000 times. The Pope tragically passed away.

When I turned on Bloomberg in the car yesterday to catch up, I had felt like I missed out on everything.

The markets were selling off. The DOW was on record for the worst start to a year since the 1930s. Dollar Tree is trading at 6-month highs.

So when I pulled up charts this morning for the first time in nearly 5 days, I expected to be horrified.

Instead, I quickly realized that absolutely nothing had changed at all since last Thursday.

And doesn’t that just sum up most bear markets?

The never ending news headlines of crap, trapping you into a negative feedback loop of FOMO, uncertainty and despair?

Remember: it’s not the media’s job to make you any money. It’s to keep you engaged so that they can monetize your attention.

Here’s what actually matters right now..

Both the S&P 500 and NASDAQ are trading above their 2021 highs for the time being but below their downwards sloping 200-Day Moving Averages.

The longer we trade below the 200-Day Moving Average, the less chance I think we see a meaningful reversal higher in the short term.

As a matter of fact, I think we see a retest of those April 7th lows soon.

The 480.00 level in SPY and the 405.00 level in QQQ are the two levels that matter the most to me.

If buyers hold those levels, shorts become increasingly more difficult to nail as the market continues to churn sideways.

Shorts get squeezed, the market dumps a day later and we’re at the same spot as we were a week ago. Rinse and repeat.

This is classic bear market price action.

A meaningful break below those key levels on SPY and QQQ means a deeper, darker correction for the market. We’ll attack the market when or if we get there.

But as long as we’re trading above those levels, we want to be cautious opening up new shorts.

These are the types of markets that are designed to beat you down, piss you off, and take your money. Don’t let it.

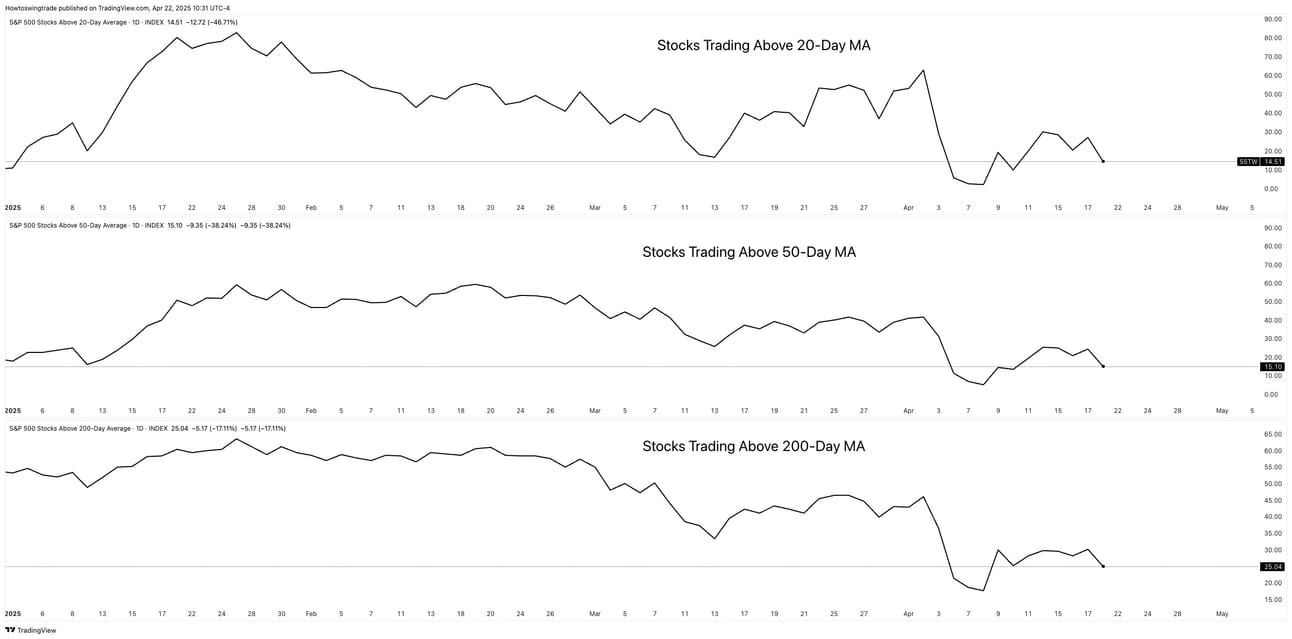

With the percentage of stocks within the S&P 500 trading below their short, intermediate, and long term moving averages, this is not the type of market we want to be buying into just yet.

Every rip so far has been an opportunity to sell short term strength or open short term shorts.

That will eventually change. And when that does, we’ll be ready.

We can build an entire thesis of the market without needing the news to tell us anything.

Tariffs, wars, inflation, interest rates, future expectations, etc are all reflected in price.

And right now, price is trending lower.

Tomorrow, I’m hosting a FREE special livestream where I’ll dive deeper into the market’s current conditions, show you exactly what a market turnaround looks like, and outline clear strategies for protecting yourself if markets keep sliding.

Join us live—it won’t cost you a dime.

In the meantime, turn off the news. Trust me, life’s a lot better.

Hamilton