- The Trading Initiative

- Posts

- Whose Lying? Silver & Gold or Bank Stocks

Whose Lying? Silver & Gold or Bank Stocks

According to the internet, only one of these asset classes can go up at a time. They're wrong.

Note: If interested in our market research services, please go to http://app.thetradinginitiative.com to learn more.

What a week for precious metals.

Gold closed at all-time highs and silver closed at 11-year highs.

But bank stocks also had an incredible week, closing at all-time highs.

And apparently that’s bad news to many on the internet.

What isn’t bad news nowadays?

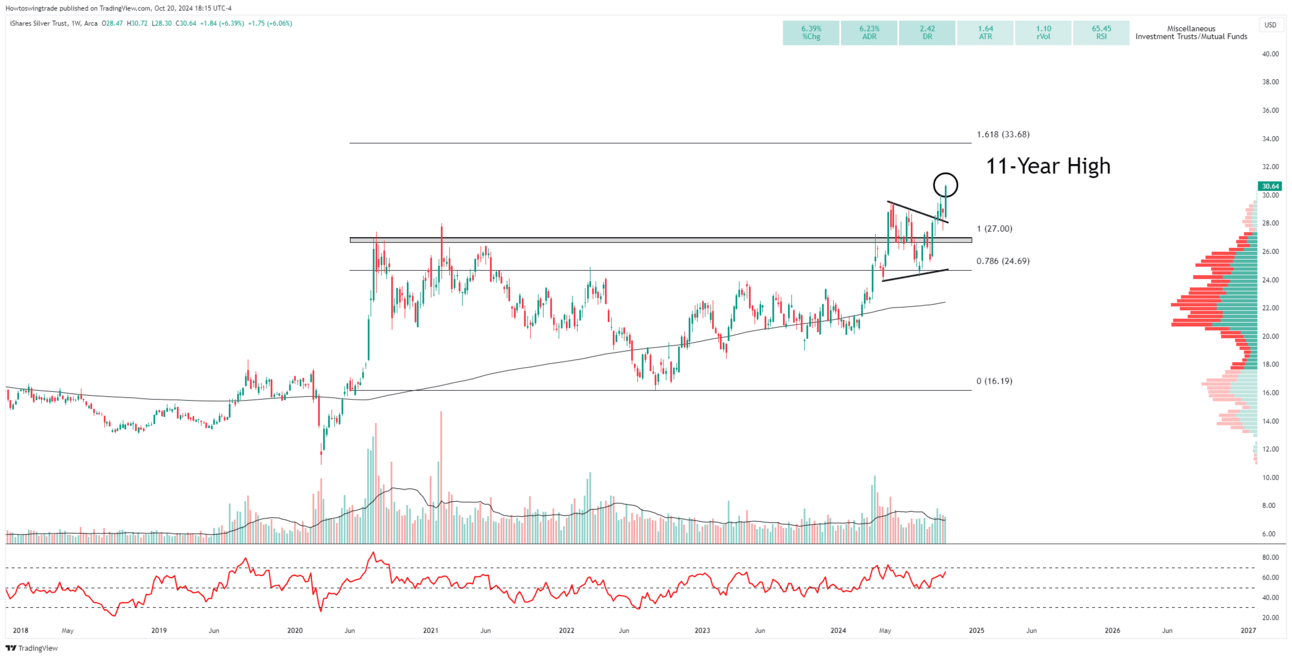

Silver ETF, SLV, Weekly

We initiated a buy on SLV 3 weeks ago as it broke above the 28.50 level after spending nearly 4-months consolidating above its previous cycle highs.

If you’re a new premium member to our market research, you can click here to see the details regarding the silver trade.

We knew that as long as silver was trading above the 27.00 pivot, there was a great chance that silver would follow gold into new absolute highs.

And last Friday we finally got the move we were anticipating.

I’m currently sitting 23.5% in profit on the SLV trade, and I have until January of 2025 to take profits.

Our momentum and trend strength indicators point to higher prices for silver over the next few months and so we’ll let this trade sit in our portfolio and continue to appreciate.

And now many folks on the internet are saying that the breakout in silver spells doom for bank stocks.

They even went as far to say that banks are sitting on the most unrealized losses since the GFC.

Maybe they’re right. I have no clue.

But here’s how I see it:

Financial Sector, XLF, Weekly

Financial stocks just closed at all-time highs.

That means they’ve never been worth more than right now.

JPM, MS, GS, KKR, Weekly

The most important bank in the world, JP Morgan Chase, just closed at all-time highs.

Goldman Sachs, Morgan Stanley, and KKR also closed at all-time highs.

I wonder if Wall Street knows whether or not these big banks are sitting on record unrealized losses?

I guess we’ll find out.

In the meantime, I am going to continue to own financial stocks because they’ve been an incredibly profitable trade this year.

Here’s what I am currently holding:

I’ll take some more of those unprofitable banks if it means more positions like this, please.

Which leads me to the last point here:

So many people are looking for the reason why something is happening instead of focusing on what is happening.

From a technical perspective, silver is breaking out because buying pressure is greater than selling pressure.

The same is true for bank stocks.

There doesn’t have to be a conspiracy theory behind everything.

And therein lies our opportunity as technical traders:

Find the strongest areas of the market and participate in the uptrends while in a bull market.

Let other people worry about the rest of the stuff.

It doesn’t really matter anyway.

If you’re tired of chasing the market around, this Wednesday at 7PM EST I’m going to be going through the five most important charts for the fourth quarter.

I’ll send out the link Tuesday night.

Mark your calendars and let’s meet up for about 30 minutes to talk about how we can make the most out of the last 2.5 months.

Talk tomorrow,

Hamilton

You can follow me on X by clicking here.

You can follow me on YouTube by clicking here.