- The Trading Initiative

- Posts

- We're at 'Bounce or Break' Levels Right Now

We're at 'Bounce or Break' Levels Right Now

Why Ignoring the Noise and Focusing on These Critical Support Levels Could Define Your Next Big Trade

Foreword: This is a post from our premium market service from earlier this morning. Given recent market fluctuations, the charts provided were from this morning at approximately 9:15am est. All charts and levels referenced remain relevant and may provide additional context to current market conditions. If you find value in our research and want a more level-headed and data-driven approach, join our community today by clicking here.

Trading your politics is a funny thing.

Ignore it completely and it vanishes from your world.

Obsess over it constantly and realize you have zero influence—plus endless frustration.

I know which one I prefer.

So let’s do what we do best in here: focus on what's actually happening, not what everyone says they think is going to happen.

Because at the end of the day, opinions are like assholes. Everybody has one.

So, what exactly are we looking for to confirm a market bounce?

Let’s dive into the charts and break it down step-by-step:

The S&P 500 $SPY has held its 2021 highs so far and continues to bounce off of the key 478.50 level.

While bearish momentum continues to be present, short-term indicators suggest that momentum to the downside is waning, setting SPY up for a tactical bounce to the upside.

In the short-term, it wouldn’t be out of question for SPY to bounce and fill the gap left between 530.00 and 536.50, or a near 8% move from current prices.

Whether the bounce evolves into a sustained uptrend isn’t clear yet.

We need (at minimum) to see:

Retests and breaks of short-term moving averages

RSI momentum shifting upward toward 50

Risk ratios stabilizing

Right now, none of these signals have triggered.

Be cautious shorting into weakness here, as downside momentum dries up and the market positions itself for a potentially vicious bear-market rally.

A break below the 478.50 level invalidates the idea of a tactical bounce higher and likely brings a deeper correction in equities.

The NASDAQ $QQQ is also holding its 2021 highs and bouncing off of its key level at 405.00.

Bearish momentum is drying up and short-term indicators suggest that the risk of shorting here is higher than the potential reward.

Much like SPY, there’s an opportunity for QQQ to bounce here and fill the gap up towards the 450.00 level, representing a potential 7.5% move to the upside from current prices.

However, breaking below 405.00 invalidates the bounce scenario.

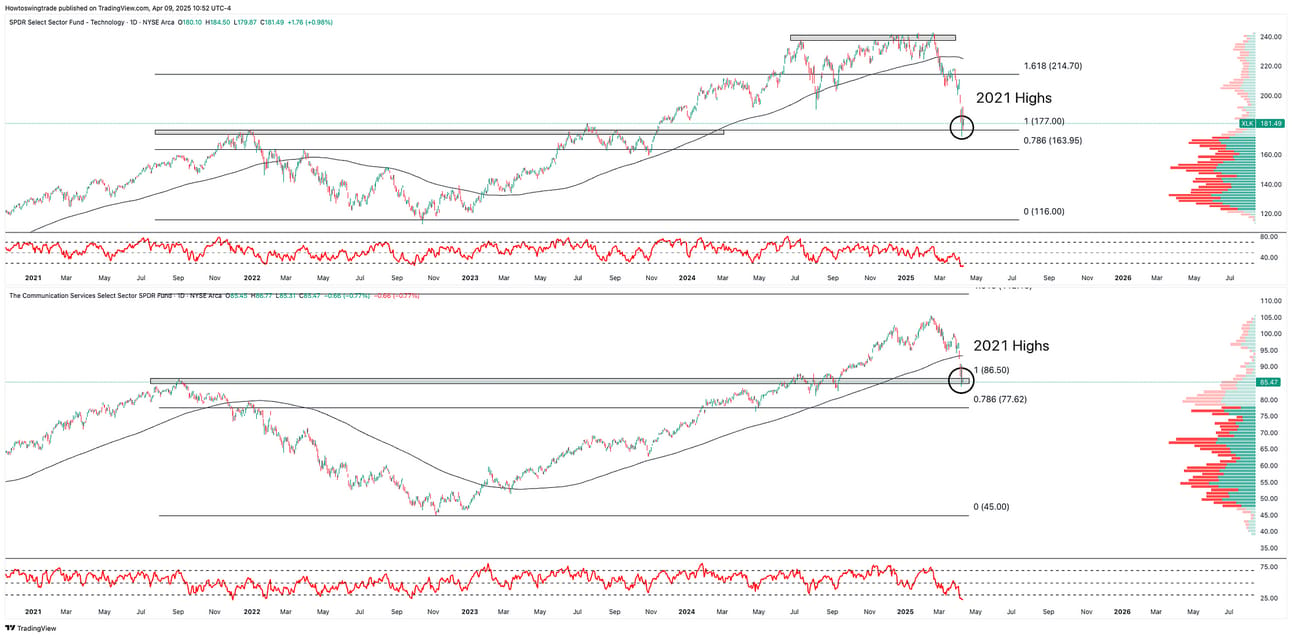

To validate a meaningful bounce or potential trend reversal, we need to see confirming signals from short-term moving averages, RSI momentum, risk ratios, and most importantly, leadership from higher-beta sectors like Technology ($XLK) and Communications ($XLC).

Both sectors are holding their crucial 2021 highs: XLK is holding the 177.00 level and XLC is holding 86.50 level.

Should the bounce in QQQ be something bigger—such as a potential trend change leading us towards all-time highs—we should see it through XLK and XLC leading the market higher.

Holding their 2021 highs is key, but it’s only a start.

We need to see them outperform, and as of right now that is not the case. Yet.

The Dow Jones Industrial Average is also hanging onto its 2021 highs.

As the Dow represents 30 of the most influential companies in the US market across various sectors, it’s essential the key level at 36,800 holds firm.

If the Dow breaks below these cycle highs, the entire bullish thesis weakens significantly.

Make no mistake: the stakes are high.

We're standing at a pivotal inflection point, similar to the tense days following the Dot-com collapse, the depths of the Great Financial Crisis, and the initial panic of the COVID meltdown.

Each of those periods felt dark and uncertain, yet each also laid the groundwork for once-in-a-decade opportunities.

Markets don’t hand out life-changing opportunities when everything feels safe.

They offer them precisely when fear feels overwhelming.

Pay attention here, because these market conditions are doing more than just testing resolve—they’re setting us up for some of the best trades and investments we’ll ever make.