- The Trading Initiative

- Posts

- 🚨 URGENT: Credit Risk Alert Is Here

🚨 URGENT: Credit Risk Alert Is Here

Something Bigger Than Tariffs is Brewing in the Credit Market

URGENT: Credit Markets Are Flashing a Major Warning

Here’s exactly what you need to know and how we’re trading it.

Before we dive in, let's quickly clarify two key instruments you need to know:

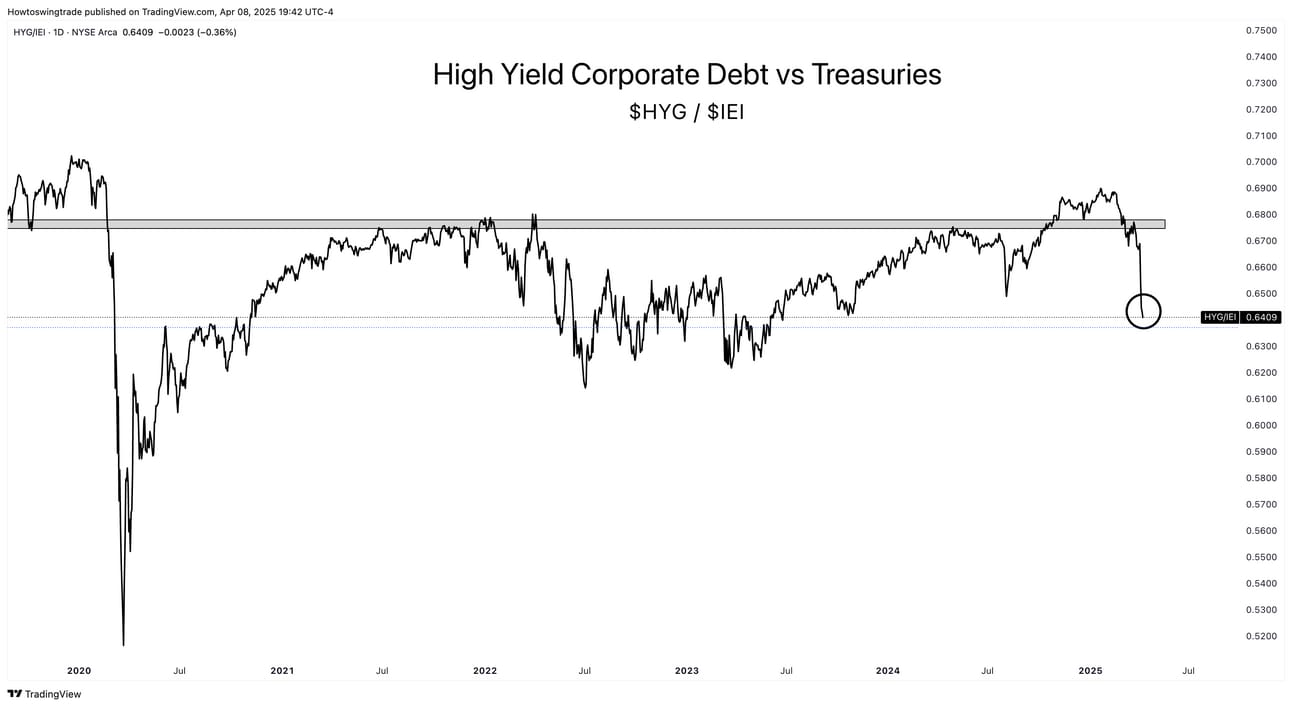

HYG (High-Yield Corporate Bond ETF): Tracks high-yield corporate bonds—riskier debt instruments issued by companies with lower credit ratings. Investors buy HYG when they're comfortable taking on more risk for higher returns.

IEI (Intermediate-Term Treasury ETF): Represents safer, intermediate-duration Treasury bonds issued by the U.S. government. Investors flock to IEI when they're concerned about market risk or uncertainty.

As technical traders focused on the three pillars of TTI—Trend, Relative Strength, and Momentum—we closely monitor the HYG/IEI ratio because it provides clear signals about market sentiment driven primarily by institutional investors, not retail traders.

This ratio directly reflects the actions of banks, hedge funds, and other large financial institutions, showing us precisely when these market giants shift from risk-on (optimistic) to risk-off (fearful).

Right now, the HYG/IEI ratio is breaking down sharply, plunging through critical support to lows not seen since early 2023.

Institutional investors—banks, hedge funds, pension funds—are aggressively moving away from high-yield corporate bonds into Treasuries.

This isn’t speculation. It’s exactly what we track daily at TTI.

They sense something bigger brewing beneath the surface than just tariffs.

The bad news? Stocks usually follow credit—and they're already showing signs.

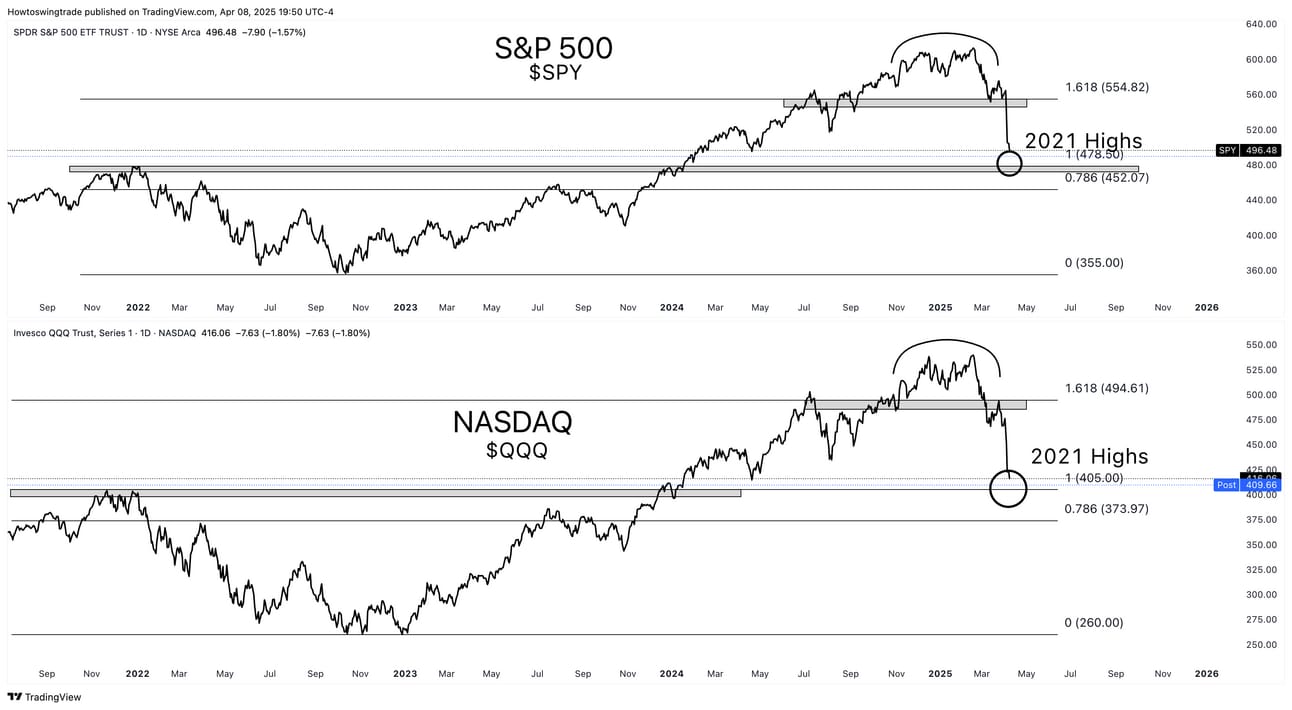

Stocks usually follow credit—and they’re already showing troubling signs.

SPY and QQQ weakened significantly over the past two weeks, closely tracking this deterioration.

Historically, such decisive moves in credit often lead to deeper equity market drawdowns.

And the market has already given up four years of profits.

The good news? Volatility creates massive opportunities.

We're already preparing our clients to profit from what's coming next.

By aligning ourselves with institutional moves through our pillars—Trend, Relative Strength, and Momentum—we capitalize on market shifts before most retail traders even notice.

Including when it’s safe to buy stocks again.

Don’t wait until the damage is done—join us now to trade alongside institutions and turn volatility into profit

Watch the HYG/IEI closely.

Any significant rebound could indicate institutions shifting back to risk-on mode—a clear signal to safely buy stocks again.

Until we see that happen, we’ll remain cautious and treat this as a risk-off environment.