- The Trading Initiative

- Posts

- 🚨 The Single Most Important Chart Right Now

🚨 The Single Most Important Chart Right Now

Why Offense vs. Defense Is the Key Signal Right Now

Markets remain incredibly volatile, bouncing aggressively last week after one of the steepest declines we’ve seen in recent memory.

Yet, despite the relief, there’s still plenty of reason for caution.

Here’s the single most important chart I’m watching right now to guide the way forward:

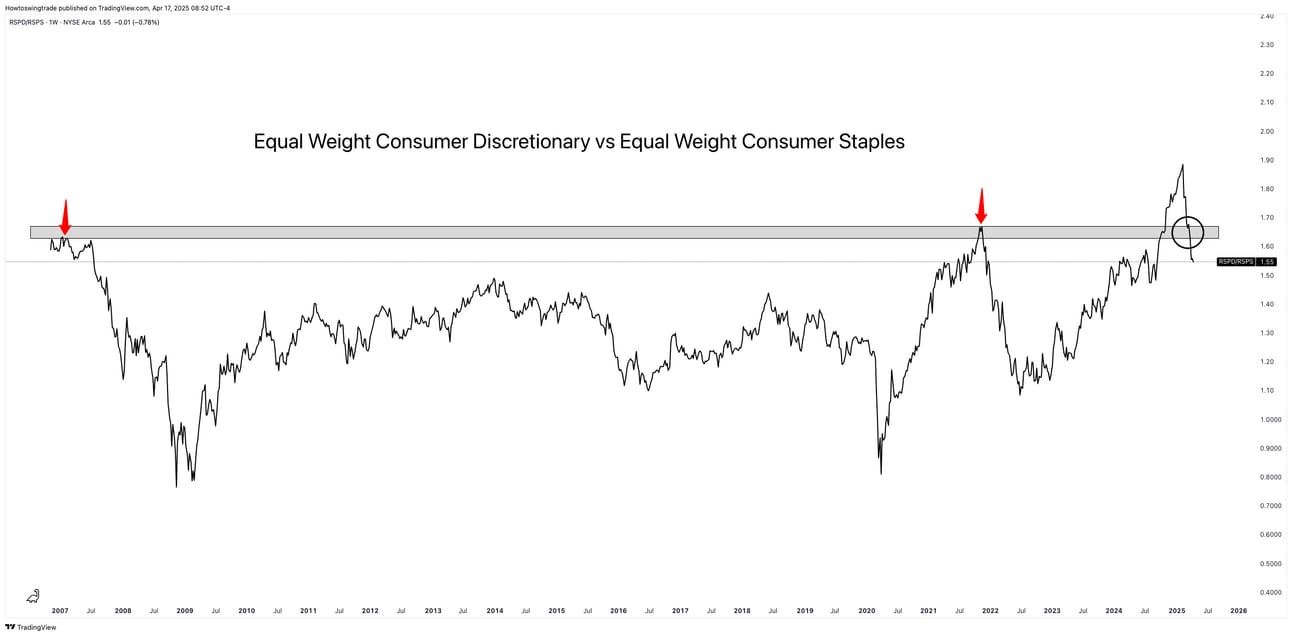

Equal-Weight Consumer Discretionary vs. Equal-Weight Consumer Staples (RSPD/RSPS)

This chart is simple—it’s “offense vs. defense,” showing clearly whether investors and traders favor aggressive, riskier stocks (consumer discretionary), or safer, more conservative stocks (consumer staples).

Right now, defense is winning. And that’s a clear red flag.

In healthy, bullish markets, investors eagerly buy riskier discretionary stocks, pushing this ratio higher.

But since stocks broadly peaked in mid-February, we’ve seen the opposite happen.

Defensive sectors like Staples have led, causing this crucial ratio to slide lower.

This relationship is our best gauge of market health right now:

If the RSPD/RSPS ratio continues moving lower, any short-term bounce in stocks will likely be short-lived.

If the ratio manages to reverse and move back above 1.67, that’s our signal that the market environment is shifting back to “risk-on”—a sign to start getting aggressive again.

For now, keep your eyes on this chart. It will tell you exactly how much risk you should be taking.

We dove deeper into this topic and specific trade ideas in yesterday’s premium Mid Monthly Market Blueprint. If you missed it and want to see exactly how we’re positioning ourselves, you can access it now:

Stay focused, trade smart, and enjoy your weekend.

Hamilton