- The Trading Initiative

- Posts

- The Most Chart In The World

The Most Chart In The World

How One Simple Indicator Can Save Your Portfolio

Everyone has an opinion about the market.

I certainly have mine.

Just today, I expected something entirely different from what actually happened.. a sharp market move in the opposite direction.

But here's the thing: markets don't care about our opinions.

That’s why I follow price.

The 200-Day Moving Average isn’t just another line on a chart.

It’s the most important indicator in the world.

And the S&P 500? The most important chart in the world right now.

Major institutions and seasoned traders watch it closely. So should you.

In trading, simplicity is king.

The 200-Day Moving Average stands out for its clarity, effectiveness, and widespread recognition.

It's the ultimate indicator for identifying the market’s prevailing trend.

Why fight the trend when trading with it is simpler and consistently more profitable?

It's All About the Slope

The real value of the 200-Day Moving Average lies in its slope:

Upward Slope: Healthy bullish trend; market momentum is strong.

Flattening Slope: Market uncertainty; proceed carefully.

Downward Slope: Market weakness; caution or defensive action is crucial

Real-World Check: SPY, QQQ, and IWM

Let's get practical: what are the charts telling us right now? How are the financial institutions positioned?

SPY: Is the 200-Day Moving Average beginning to flatten, signaling caution ahead?

QQQ: Tech stocks have been leaders, but how does the 200-Day slope look today?

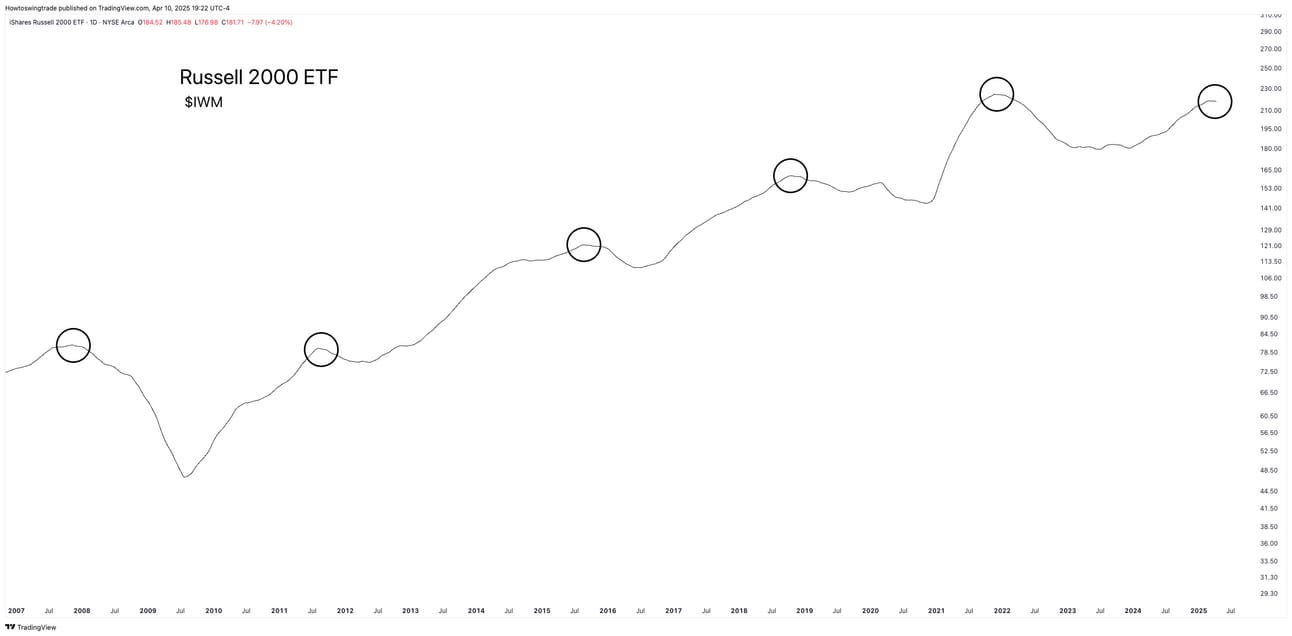

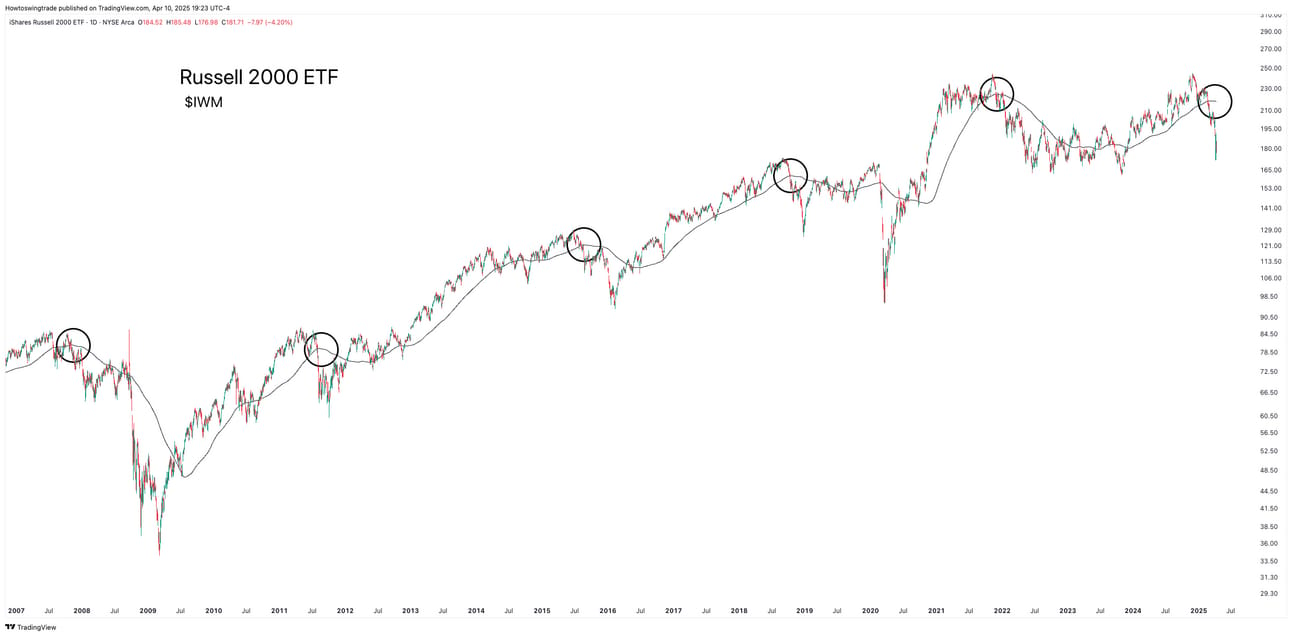

IWM: Small caps often lead major market moves—what's their 200-Day slope indicating?

Now let’s look at those with price shown.

SPY:

QQQ:

IWM:

How many major market drawdowns could you have mitigated by simply following the downwards sloping 200-Day Moving Average?

Keep It Simple (Stupid)

Listen, the 200-Day Moving Average isn’t perfect.

You won’t sell every top or buy every bottom.

But what it does is ensure you’re trading with the prevailing trend.

The 200-Day Moving Average doesn’t care about inflation reports, politics, or your market predictions.

It only cares about reality.

If there’s one trading rule you follow, let it be this:

Respect the 200-Day Moving Average.. and especially its slope.

What is it telling us right now?

Is this the time to be pressing large amounts of risk into the market? Or (at best) should we be waiting for more information before choosing a directional bet?

Are You Prepared for What's Next?

Ready to trade smarter and stay ahead of market moves?

Markets are speaking. Are you prepared for what's next?