- The Trading Initiative

- Posts

- New Opportunities Everywhere

New Opportunities Everywhere

The market is sending a powerful signal right now that you cannot afford to miss

If you haven’t noticed, risk is flooding the market once again.

Not only are Bitcoin and the cryptocurrency markets at all-time highs, but we’re seeing some of the riskiest areas of the equity market now break out.

Tomorrow we’re going live to cover NVDA’s earnings report and to talk about the future of the market.

This is not something you’re going to want to miss if you enjoy making money.

This exclusive session, previously reserved for only TTI members, is available to you for free by clicking here.

We’ll start at 3:50PM EST and run approximately 1-hour. I look forward to seeing you there.

The underperformance in large cap Technology stocks relative to the broader market is not new.

Since peaking in early July, many of the most important stocks in the market haven’t really done anything.

Look at how the Technology sector has failed to breakout into new all-time highs, meanwhile other growth sectors such as Consumer Discretionary and Communications have:

And yet many investors and traders are treating these types of stocks as the types of stocks that are going to consistently make them money.

Stocks like MSFT which are is currently off over 10% from its all-time high and trading below its 200-day moving average.

It’s just not happening right now.

Luckily for us, we don’t have to trade things that aren’t performing well.

Instead, inside of TTI we focus on where the money is flowing.

Which sectors, industry groups, and stocks are outperforming the broader market?

And it just so happens, a familiar theme is beginning to emerge.

ARKK is breaking out into new yearly highs following a 80% drawdown during the 2022 bear market and consolidating over the last 2 years.

I don’t know about you but ARKK, the poster child for very risky, high beta growth stocks breaking out into new highs does not scream risk-off to me.

As a matter of fact, it's the exact opposite. It’s screaming to get MORE risk into the market.

Just like in 2017 and 2020, traders and investors who are able to identify this opportunity early are going to outperform everyone else who fails to buy these kinds of stocks.

I’m talking stocks like SQ, AFRM, GRAB, LMND and more.

SQ, AFRM, GRAB, LMND

They all represent the same idea: highly speculative, beat to crap growth stocks that are breaking out into stage-2 uptrends after a prolonged stage-1 base.

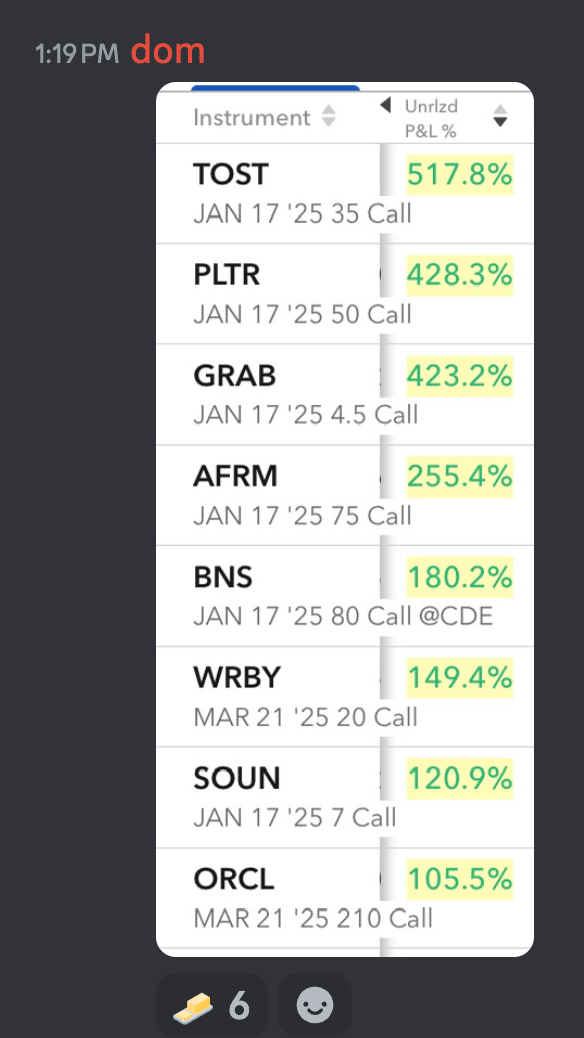

We have positions in all four of these, among many others which are currently breaking out as well.

I encourage you to check out our trade idea on GRAB, currently sitting between 900% and 1,500%, to get a better understanding of how we take our trades. Click here to read through the original trade idea on our market research portal.

But it’s not just ARKK and higher speculative plays breaking out after peaking nearly 3+ years ago.

The recent breakout in the total crypto market cap which we talked about here also plays into the idea that the balance of risk is flowing strongly in the direction of risk on.

After spending the last 3+ years underneath its 2021 high, the market cap of the entire crypto ecosystem is breaking out into all-time highs.

TOTAL

What does that mean for asset prices within the cryptocurrency market?

For Bitcoin, it means $100,000 is only 8% away after breaking out from underneath its 3-year range over 2 weeks ago.

BTCUSD

So not only are we seeing the riskiest equities breaking out into new highs after years of being beat to crap..

We’re also seeing the riskiest asset class break out into new highs after years of being beat to crap.

Are you willing to make the bet that these don’t continue higher?

Or does it make more sense that these multi-year breakouts, in the third year of a bull market, continue to trend upwards and pay traders and investors who own them?

We’re making the bet that they continue higher. And we’re buying everything we can get our hands on that fits the description.

What’s stopping you from buying setups like TOST as they breakout?

TOST

Or WRBY?

WRBY

Have you noticed that every single chart I have posted is the exact same setup?

It’s because it works. I encourage you to look at the results themselves.

Which takes me to my last point:

Are you late? Not at all.

We’ve been saying it all year and we continue to see evidence of a higher probability chance we end this market higher than where we are currently trading.

And there are still many, many stocks setting up to breakout for the first time in years.

What’s wrong with BROS, a 7.68bn coffee company that gapped up on earnings and is breaking out into new 2 year highs after a week of consolidation?

BROS

Or DDOG, a 45bn software company looking to break out after nearly 1-year of sideways consolidation?

DDOG

There’s so many popping up that it’s almost overwhelming. But therein lies a lot of opportunity to make money.

So join us tomorrow at 3:50PM EST for our live stream covering the NVDA earnings report and let’s talk about them.

I guarantee you that you’re going to learn something new (and potentially make a couple bucks, too).

I look forward to seeing a bunch of new faces and talking stocks with you.

Hamilton

You can follow me on X by clicking here.

You can follow me on YouTube by clicking here.