- The Trading Initiative

- Posts

- Make the Process Hard (And Your Trading Will Get Easier)

Make the Process Hard (And Your Trading Will Get Easier)

Do What Others Won't to Make More Than Others Want

Yesterday I was asked a question: should the process of buying stocks be easy or hard?

Here's an idea most traders never fully embrace:

Make the process difficult.

Sounds counterintuitive, right?

Trading is already challenging enough.. why make it harder?

Because when you add strict, clear, and non-negotiable rules to your trading process, you're forced to respect discipline.

You stop taking trades just for the sake of trading, boredom, or impulsivity.

The odds of placing meaningless, low quality trades diminish exponentially.

That means no more YOLOs (or, at least, significantly cutting down on the number of them).

When you set firm rules, the trade has to prove itself worthy.

It has to earn the right to be in your portfolio.

Our "Must-Have" Trading Rules:

Before even considering a stock, ask these tough questions:

Is it trending higher? Where is the 200-Day Moving Average and what is its slope?

Does it have relative strength compared to the broader market or its sector peers?

Does it exhibit clear bullish momentum? Where is the RSI?

Is it part of a leading sector or industry?

If the stock doesn't check off every single one of these boxes, with no exceptions, it doesn’t make the cut.

Why This Works:

By being strict about these "must have" rules, you immediately filter out weak trades, such as:

Stocks in strong downtrends

Stocks that lack momentum

Relatively weak stocks

Stocks in declining or lagging industries

What’s left?

Only stocks with strong trends, clear relative strength, proven momentum, and belonging to sectors and industries that the financial institutions are pushing higher right now.

These are high quality trades with a significantly higher probability of success.

Top-Down vs. Bottom-Up

Our approach isn’t just strict.. it's strategic.

It’s the same basic process that large fund managers use.

We use a top-down process rather than bottom-up.

A top-down approach starts with the big picture, looking first at things such as sectors and industries before focusing on individual stocks.

This process is not only more efficient, but it's also far more profitable over the long term.

By identifying things like leading sectors first, you ensure you're focusing your efforts and resources on the strongest areas of the market.

Additionally, the top-down method keeps you poised and patient.

You're forced to consider broader market trends rather than impulsively jumping into a trade based solely on a single stock setup.

It removes the temptation to react impulsively and keeps you focused on the bigger, more reliable picture.

Current Example:

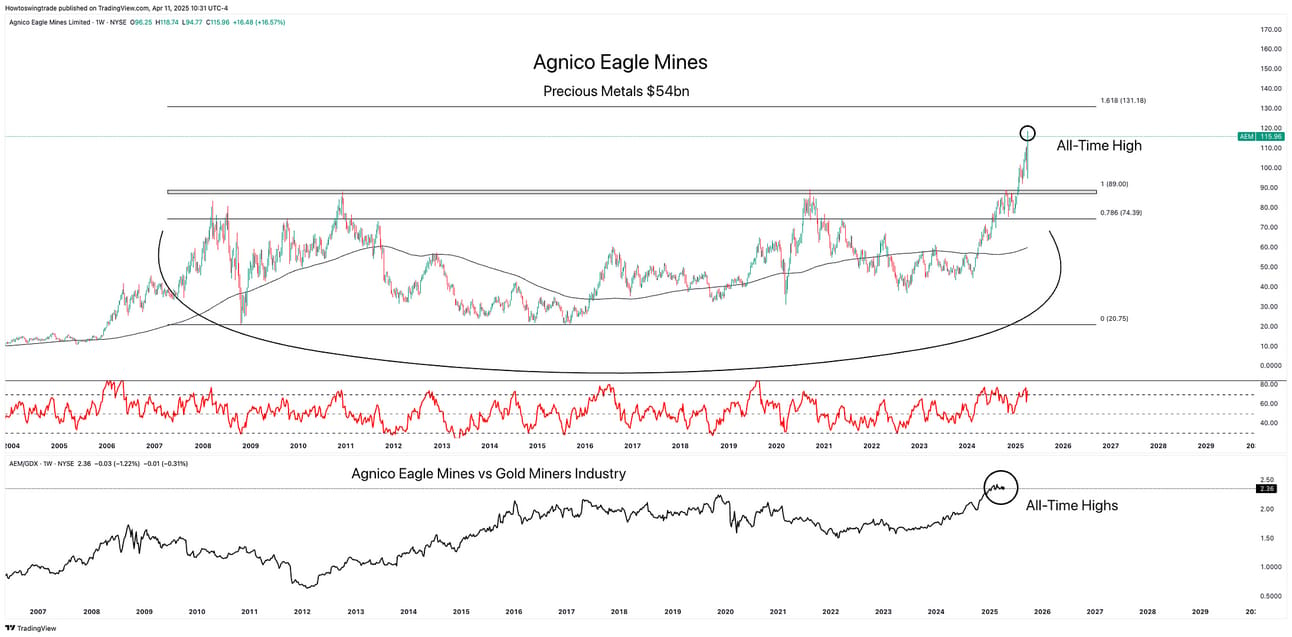

Our positions in Gold Miners such as AEM and KGC exhibited all three of the major characteristics we look for before entering positions.

Back in January when we opened these positions, the market had yet to begin its descent and buying Gold Mining stocks in a raging bull market is generally counter-intuitive.

But that’s why we don’t trade off of impulse or bias; we follow the rules of the system.

Take our trade on Agnico Eagle Mines $AEM as an example:

Let’s go through the checklist together.

$AEM was..

Within Gold Miners GDX, an industry-leading area of the market,

Trading above its upwards sloping 200-Day Moving Average,

Trading within a bullish momentum regime,

Outperforming its industry group,

Trading into all-time highs

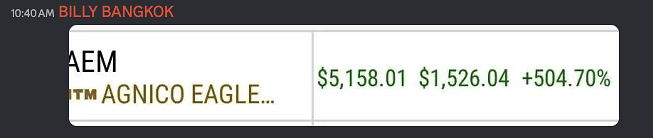

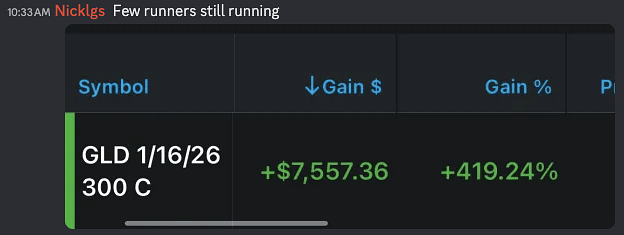

And here’s the current result from earlier today:

By sticking to our criteria, we don’t question where or why the market is headed.

Or in Gold’s case: when the move is going to be over.

We bought the breakout in March 2024 and have added in multiple times since.

Not because we’re Gold Bugs, or we care about inflation, or we think it’s better or worse than Bitcoin, or anything.

We bought it because it was:

Outperforming stocks,

Breaking out into an all-time high,

Trending higher above an upwards sloping 200-Day Moving Average,

And within a bullish momentum regime

And here’s the current result from earlier today:

The Beauty of Tough Rules

Most traders struggle because they're constantly looking for reasons to trade.

But the best traders do the exact opposite.. they're always looking for reasons NOT to trade.

When you make your process demanding, your decisions become easier, clearer, and more disciplined.

You stop gambling on whims and start executing based on objective criteria.

Higher Probability, Better Performance

The trades you ultimately choose will naturally carry a higher probability of working out.

Why? Because they've passed through rigorous screening. They’re battle tested. They've earned your trust.

Your job as a trader is not to take every trade.. it's to take the right trades.

Good trading isn't about quantity; it's about quality.

Embrace a difficult selection process, and trading actually becomes easier and far more profitable over the long term.

Make Your Process Tough. Make Your Trading Easy.

If you only remember one thing, let it be this:

Make the stock prove to you it deserves your money.

Respect your rules, trade less, trade smarter, and you will make more money.

There’s no sales pitch. If you find value in the idea of having a repeatable process based on data you can click here and join our community. We talk through this process every day.

If not, that’s just fine as well. I hope you learned something from it!

Talk to you tomorrow.

Hamilton