- The Trading Initiative

- Posts

- Is This the Bottom—or Just a Trap?

Is This the Bottom—or Just a Trap?

Why Friday's bounce isn't enough to go all-in (yet).

Is the Bottom Really In?

That's been the question of the week. Actually, it's been the question I've heard more in the last few days than at any point in the past five years.

Bottoms are tricky. Sure, buying dips is great when the market is trending strongly higher, but when the trend flips, it can quickly become a trap.

Being early often means being wrong, especially with options where timing is everything.

Yes, Friday looked promising.

But remember, it was just one day. We talked extensively about this on Saturday over on X (if you missed it, you can catch up here).

Right now, the long-term trends we've trusted for the last two years are showing real signs of trouble.

Caution isn't just advised—it's mandatory until we see clear evidence the market is truly recovering.

Yet, there's a silver lining worth paying attention to.

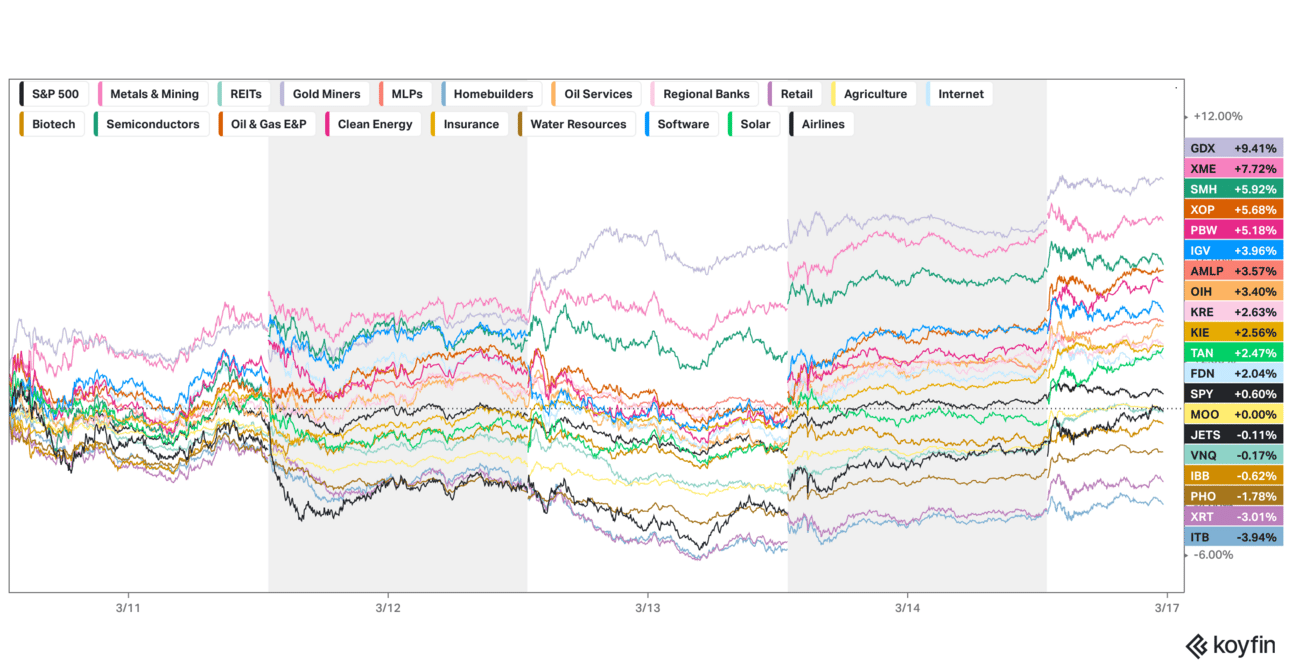

Take semiconductors, for example.

They led the market lower after NVDA earnings, but they're now starting to show surprising strength.

While it's too soon to go big on semis, they're definitely on my radar if a sustained bounce comes.

And the S&P 500? It found crucial support exactly at its 1.618 Fibonacci extension last Friday.

These levels are textbook bounce zones in uptrends.

Tonight at 7 PM EST, I'll dive deeper into what's really happening with the market in our live Price Action Playbook session.

We’ll cover emerging trends, pinpoint hot sectors and stocks setting up right now, and map out exactly how to trade them.

If you're not part of our paid service, you can still join tonight's event for only $100.

If you like what you see (and I’m confident you will), we'll have a special offer waiting for you at the end.

See you tonight!