- The Trading Initiative

- Posts

- 💰 Is The Gold Bull Market Just Getting Started?

💰 Is The Gold Bull Market Just Getting Started?

The Market Setup You Can’t Afford to Miss

Right now, the market is flashing a massive opportunity, and you need to pay attention.

Gold is quietly kicking off what could be a significant bull market—and institutional money is already on the move.

Banks, hedge funds, and asset managers aren't hesitating, so why should you?

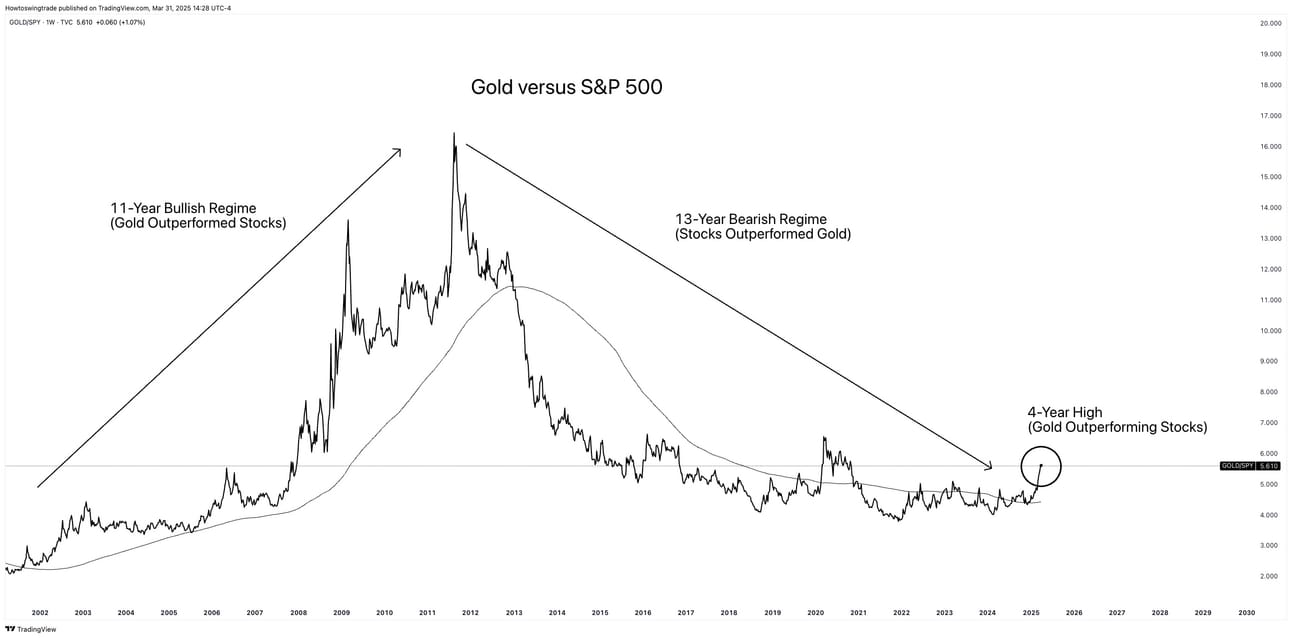

Gold's recent strength versus the S&P 500 isn't random.

It's a crystal-clear signal from the big money players who sense risk ahead: inflation, uncertainty, and a weak Tech sector.

They're swiftly repositioning billions into Gold—and that's your opportunity.

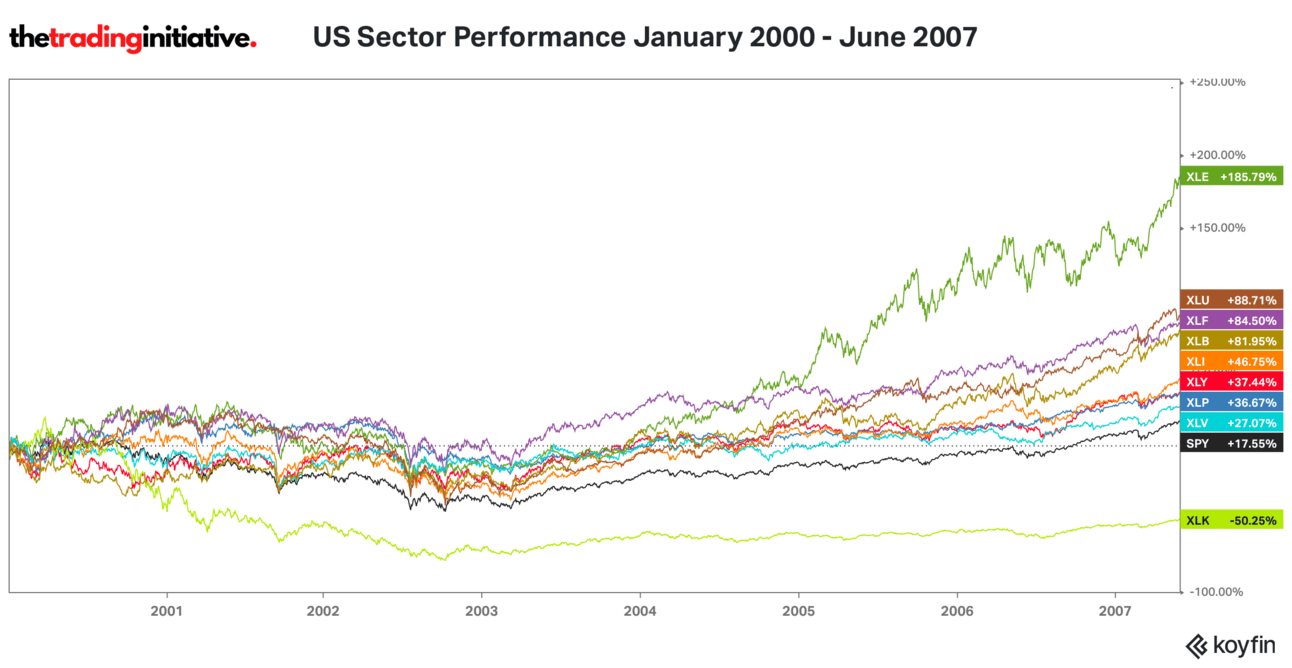

We've seen this movie before.

Between 2000–2007, institutional rotations into Energy, Financials, and Materials created fortunes, while investors holding onto Tech got crushed.

Today, Gold (GLD) is outperforming equities (SPY) again, mirroring that exact setup.

And with that comes a ton of new opportunities to make money in the market.

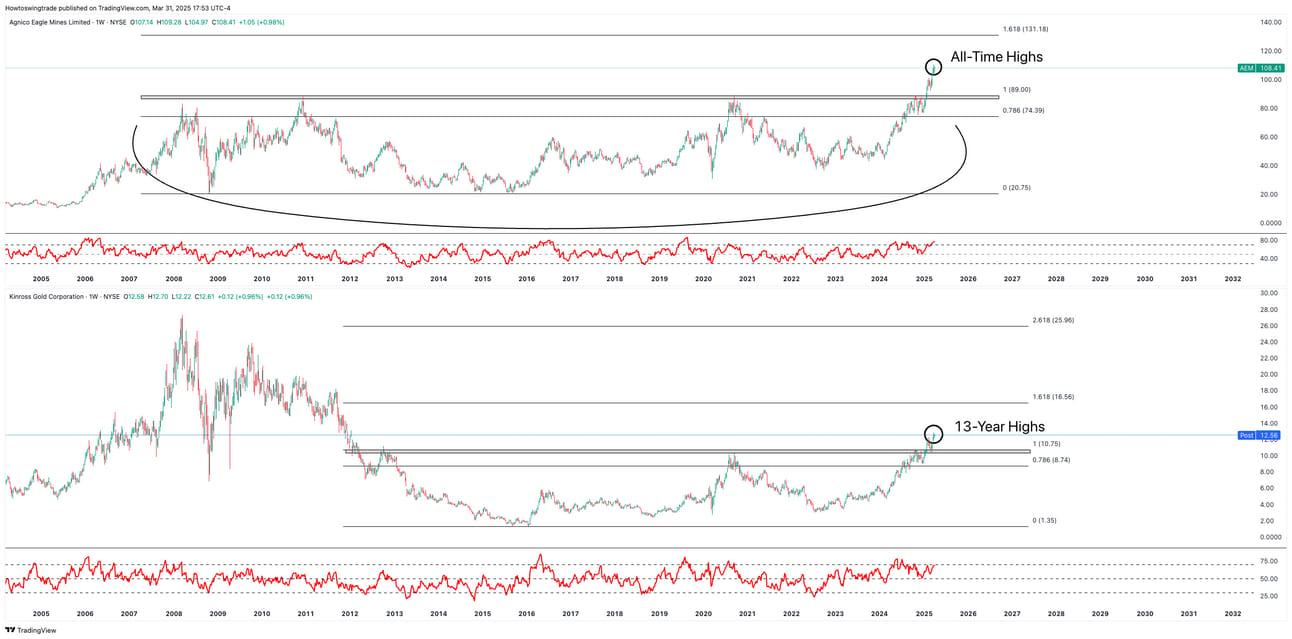

Especially in the Gold Miners which are breaking out into multi-decade highs.

We've already positioned our clients perfectly for this move, currently holding profitable trades in Agnico Eagle Mines (AEM) and Kinross Gold (KGC).

Both positions are outperforming, proving that aligning with institutional money early can lead to significant returns.

The Trading Initiative’s Monthly Market Blueprint breaks down exactly how to capture these shifts:

Institutional rotations and key sector leadership

Powerful trade setups you can use right now

Risk management strategies to protect your capital

Given the market volatility—especially with Trump’s latest tariffs—this isn’t the time to guess.

This is your chance to follow the smart money and position yourself into new uptrends.

Don’t wait. Spots fill quickly. Join our next Monthly Market Blueprint session this Wednesday at 7PM EST.

Do you have enough exposure to Gold and Gold Miners right now? How about Silver?

Let me know!