- The Trading Initiative

- Posts

- Bottom fishing bonds

Bottom fishing bonds

Yields are topping, bonds are bottoming, recession is.. recessioning?

As the great American recession continues to elude the stock market, something peculiar is taking place.

Bonds are in the process of finishing an extensive bottoming out process and could be setting up for an incredible run to the upside.

Check out these four massive bases in bonds of all flavors:

SHY, IEF, TLT, HYG, 1D Timeframe

Short term, intermediate term, long term and even high yield government bonds are pressing higher after spending 2+ years consolidating.

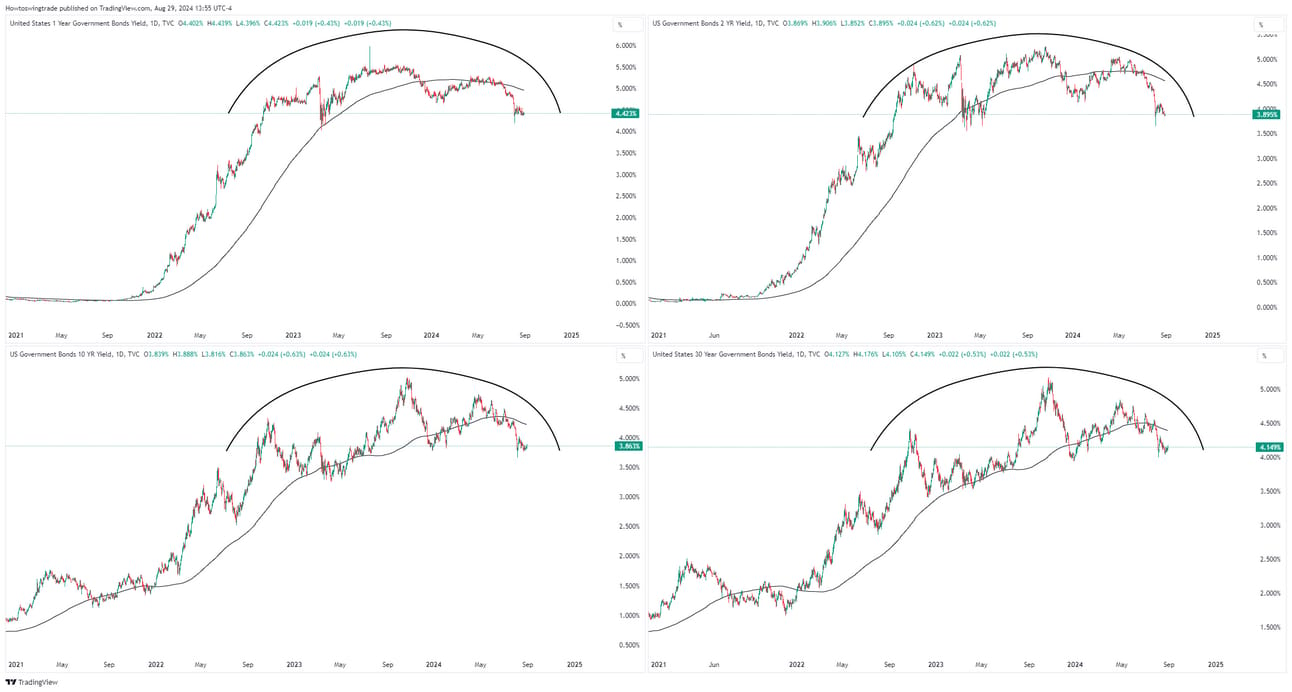

Just check out these yields! Certainly looks like they are beginning to break down from a topping out process, don’t they?

1-Year, 2-Year, 10-Year, 30-Year Yields, 1D Timeframe

And if the bond market starts to really heat up, what do you think that means for stocks?

Unless we somehow shift from an inflationary market regime towards a deflationary market regime overnight, we think it means stocks continue to press higher.

Don’t believe me? Just check out the positive correlation between TLT and SPY over the last 2.5 years.

I encourage you to check it out! I bet you’ll be surprised to see.

Now we’re already long some of the 20+ year bonds through the TLT ETF and we are looking to add more soon.

We’re going to talk more about this tonight during our webinar, including how we find setups like this daily using our top-down approach.

If you’re interested, click the video below and RSVP by clicking “Notify Me!” to be reminded 5-minutes before we go live.

We’ll start at 7PM EST on the mark and should run about 60 minutes.

I look forward to seeing you tonight!

Hamilton