- The Trading Initiative

- Posts

- Are you bullish enough?

Are you bullish enough?

This is the 44th all-time high for the S&P 500 just this year..

This week marks the beginning of the third year of this current bull market.

But it’s more than just that..

Did you know that this is the best year in the 21st century for the S&P 500?

I knew it was a great year, but I had no idea it was the best year in over 24 years.

To no one’s surprise, it’s been a great year to be a bull.

And what happens in bull markets?

All-time highs. A lot of them.

S&P 500, SPY, Daily

The S&P 500 closed again at all-time highs today.

That marks the 44th all-time high for the S&P 500 this year.

But what’s more compelling is what is fueling this most recent breakout into all-time highs.

It’s not what was working during the summer.

As a matter of fact, it’s a completely different type of stock..

US Industry Performance August 5th - Current Date

When the market failed to re-test and take out those August 5th lows, we knew it was time to put risk back into the market.

We identified that high beta sectors and industries were outperforming against the broader market and bought them.

Check out the software industry closing at all-time highs today after consolidating underneath its previous cycle highs all year:

Software Industry, IGV, Daily

And check out the types of individual software stocks leading this industry-wide breakout.

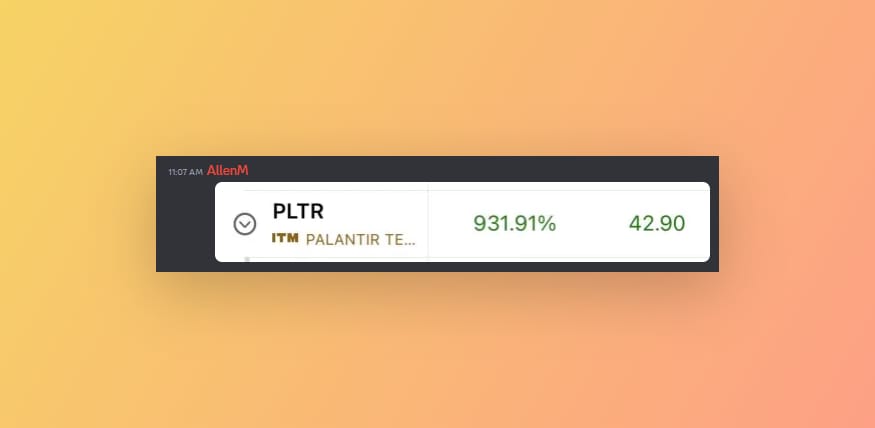

How about Palantir which closed at all-time highs today?

Palantir, PLTR, Daily

This is the current trade we put on in August after it failed to take out its 200-day moving average:

There is a lot of opportunity in the market to take advantage of when everyone is freaking out if you can settle down and focus on what matters.

Which leads me to the last portion of this..

Do we really think that software stocks are going to stop working here after spending the last 9-months consolidating underneath their all-time highs?

I do not. At all.

Or how about communication stocks breaking out into all-time highs earlier this month after spending the last 3-months consolidating?

Communications Sector, XLC, Daily

These are generally not followed by a breakdown into new lows.

If I were a betting man, which I am, I’d assume these continue to breakout into new all-time highs and close higher by the end of the year.

As a matter of fact, that’s exactly where my money is at.

I encourage those of you who have struggled to catch a grasp of this market to take a peek at our market research service.

We’ve been bullish this entire year because the weight of the evidence has told us to be bullish this entire year.

And we’ve made a killing doing so.

Are you long any software stocks right now? Which is your favorite?

We’re looking at putting more positions on. Feel free to reply to this email and let me know what you’re looking at.

See you tomorrow morning,

Hamilton

Follow me on X by clicking here.

Follow me on YouTube by clicking here.